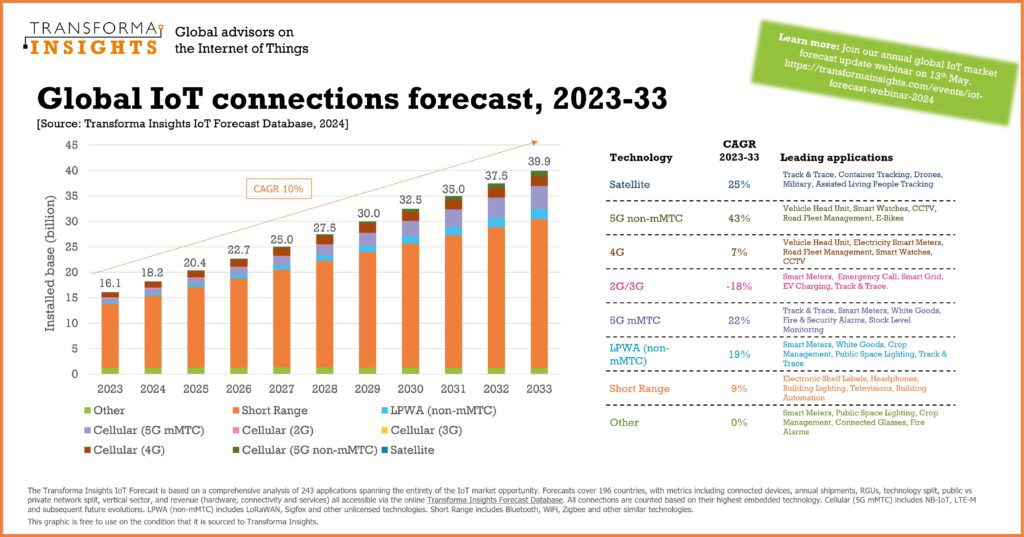

The number of active IoT devices will more than double to 40 billion by the end of 2033, according to IoT analyst house Transforma Insights. Short-range IoT technologies will account for 73 percent of the total by the end of the period; cellular IoT connections, mostly on LTE-based NB-IoT and LTE-M (and related technologies), will account for most of the rest, with about a 19 percent share of the total. The total IoT market will be worth $934 billion, it said.

In terms of relative growth, non-cellular low-power wide-area network (LPWAN) technologies like LoRaWAN will be most successful. Connections based on these technologies will more than quadruple over the period (up 456 percent) to number two billion by the end of 2033, compared with around 360 million at the end of 2023. This represents compound growth (CAGR) of 19 percent per annum over the period, according to Transforma Insights. Cellular IoT will also outpace the market, tripling volumes (up 295 percent) from 1.9 billion to 7.5 billion over the next 10 years.

The CAGR of cellular-based LPWAN technologies like NB-IoT and LTE-M will be 22 percent, it calculates; but the overall cellular IoT figures are offset by slower CAGR numbers for straighter LTE (4G; seven percent) and a total reversal for sunsetting 2G/3G standards (down 18 percent in the period). By turn, broadband 5G-based IoT connections – using the 5G NR standard, and not classified as LPWAN-style ‘massive machine-type comms’ (mMTC) – will show a neat turn of pace, with CAGR of 43 percent in the period, although they will remain shy of the billion-mark in volume terms even after a decade-ish of sales.

The biggest non-mMTC 5G use case is vehicle head units, accounting for 41 percent of connected in 2033, said Transforma Insights; kit also cited connectivity for smart watches, security camera (CCTV) systems, fleet management, and eclectic bikes. By turn, IoT connections using short-range IoT technologies will reduce in terms of market share, from 79 percent of total connections (12.7 billion) in 2023 to 73 percent in 2033 (29 billion); their CAGR is forecast as nine percent. Transforma Insights has supplied a helpful graphic to make sense of it (see below).

The total IoT market will grow at 148 percent and 179 percent in terms of connections and revenues volumes, respectively, from 16.1 billion and $335 billion at the end of 2023 to 39.9 billion and $934 billion at the end of 2033. Annual device sales will grow from 4.1 billion in 2023 to 8.7 billion, at a CAGR of eight percent. Revenue includes spending on connectivity modules, value added connectivity, and core associated applications; the latter disciplines will account for 10 percent and four percent of total IoT spending in 2023, it said. The predicted 10-year CAGR figures for connection and revenue volumes are 10 percent and 11.5 percent.

There is more: the consumer sector will account for 61 percent of all IoT connections in 2033; 35 percent of enterprise IoT devices will be for ‘cross-vertical’ use cases in 2033 (“such as generic track-and-trace, office equipment, and fleet vehicles”), 24 percent will be deployed by utilities (“most prominently smart meters”), 22 percent by retail/wholesale (“predominantly payment processing devices and electronic shelf labels”), seven percent by government, four percent by transport and logistics, and three percent for agriculture.

(Curiously, there is no reference to traditional industrial IoT in factories and plants (Industry 4.0) – which would suggest, perhaps, that Transforma Insights is counting cellular IoT on public networks, rather than on private networks, as industrial IoT would more commonly be connected. Which would confuse the picture, just because non-cellular short-range IoT, and often non-cellular wide-area IoT, is typically connected on private enterprise networks, in one form or another. Anyway, RCR will be in touch to clarify.)

Transforma Insights says China, North America, and Europe dominate for IoT connections, accounting for 32 percent, 21 percent, and 19 percent of the total market respectively in 2033. It calls its new report – comprising a forecast database, plus forecast insight reports – “ultra-granular”.

Matt Arnott, principal analyst at Transforma Insights, said: “Growth… continues at a steady pace, reflecting the diversity of use cases encapsulated within the concept. It’s not a hockey stick and never has been, but a series of micro-markets that each have their own dynamics, with some growing faster and others slower. There are micro-level factors that can massively accelerate growth … [and] macro-level trends which will also have knock-on effects… To forecast the IoT market you need to understand both, and much more besides.”

Matt Hatton, founding partner at Transforma Insights, said: “Transforma Insights analysts have been forecasting the IoT market opportunity for over a decade. Back in 2011 our analysts’ expectation of 12 billion IoT devices by 2020 was close to the bottom of the league table of predictions but proved to be easily the most accurate. Today as Transforma Insights our team continues to provide the most extensive and deeply researched forecasts of the IoT, making ours the benchmark against which all predictions of IoT market growth should be compared.”

This post was originally published on the 3rd party mentioned in the title ofthis site